Top 10 Women Owned Businesses By Ethnicity

7113731563 • August 7, 2025

Top 10 Women Owned Businesses By Ethnicity

Sofia Sefchick sits in her yoga studio and apparel store, Hello Yoga, in Reno, NV. Photo courtesy of Noticiero Movil.

Women-owned businesses are growing faster than any other segment of the U.S. economy. As of 2024, women own more than 13 million businesses, generating $2 trillion in annual revenue

and employing over 9 million people.

Whether you’re launching or expanding, SBA loans

are often a critical component for growth, especially when traditional lenders hesitate. If you’re a woman entrepreneur, or you're advising one, this list will show where the momentum is and where smart capital can make a difference.

Top 10 Industries for Women Owned Businesses

These are the most common and fastest-growing industries where women are launching and scaling businesses:

1. Health Care & Social Assistance

Recession-proof, purpose-driven, growing.

Recession-proof, purpose-driven, growing.

2. Professional, Scientific, Technical Services

Consulting, legal, marketing, design, tech

Consulting, legal, marketing, design, tech

3. Administrative & Waste Management

Virtual assistance, janitorial, staffing, HR

Virtual assistance, janitorial, staffing, HR

4. Retail Trade (Online & Physical)

E-commerce boom, low startup costs, scalable

E-commerce boom, low startup costs, scalable

5. Accommodation & Food Services

Restaurants, bakeries, catering, hospitality

Restaurants, bakeries, catering, hospitality

6. Educational Services

Tutoring, coaching, online courses, childcare

Tutoring, coaching, online courses, childcare

7. Real Estate, Rental & Leasing

Prop managers, brokerages, short-term rentals

Prop managers, brokerages, short-term rentals

8. Finance & Insurance

Bookkeeping, tax prep, financial planning

Bookkeeping, tax prep, financial planning

9. Arts, Entertainment & Recreation

Creative services, wellness, fitness studios

Creative services, wellness, fitness studios

10. Manufacturing (Small Batch & Niche)

Beauty products, apparel, artisan goods

Beauty products, apparel, artisan goods

Breakdown by Ethnicity

Black Women Owned Businesses

- Fastest

growth rate of any demographic.

- Popular industries:

- Hair and beauty

- Health and wellness

- Retail and e-commerce

- Childcare and education

- Many rely on personal funding or community capital.

- SBA microloans and Express lines of credit

are often critical for launching or restocking inventory.

Latina Owned Businesses

- Represent 1 in 10 women owned businesses

in the U.S.

- Common sectors:

- Food service (catering, food trucks)

- Cleaning services

- Retail and clothing brands

- Professional services (translation, legal aid, consulting)

- SBA loans can help secure vehicles, equipment, or real estate for expansion.

Asian American Women Owned Businesses

- High representation in:

- Healthcare and medicine (clinics, therapy, wellness)

- Education services

- E-commerce and specialty retail

- Technology and SaaS startups

- Many qualify for SBA 7(a) and 504 loans to fund offices, tech, and staffing.

Native American Women Owned Businesses

- Strong presence in:

- Artisan manufacturing

- Agriculture

- Cultural education and tourism

- Environmental consulting

- Often located in rural areas where Community Advantage loans and 504 rural development loans are ideal options.

How SBA Loans Power Women Owned Businesses

Most women-owned businesses are under capitalized, not because of lack of vision, but because of systemic lending gaps.

Here’s where SBA loans

help level the playing field:

SBA Loan Type Best Use Case

7(a) Working capital, business acquisition, expansion

504 Equipment, real estate, construction

Express Fast working capital or startup needs

Microloans New ventures, solopreneurs, small inventories

These loans offer lower down payments, longer terms, and in many cases, no collateral required. That’s a game-changer if you’re trying to get started or scale quickly.

Final Thoughts

Women are redefining what business ownership looks like across every industry. But growth still requires funding, and that's where SBA loans come in.

Whether you're running a childcare center, launching a wellness brand, or acquiring a second location, the right financing helps you move faster, hire sooner, and grow smarter.

At ComCap, we help women owned businesses access SBA funding — even when traditional banks say no or don't lend enough.

✅ SBA 7(a), Express, and 504 Loans

✅ Available nights, weekends, and holidays

✅ We move fast and can closing in 10 days

Need help funding your next step?

Let’s talk.

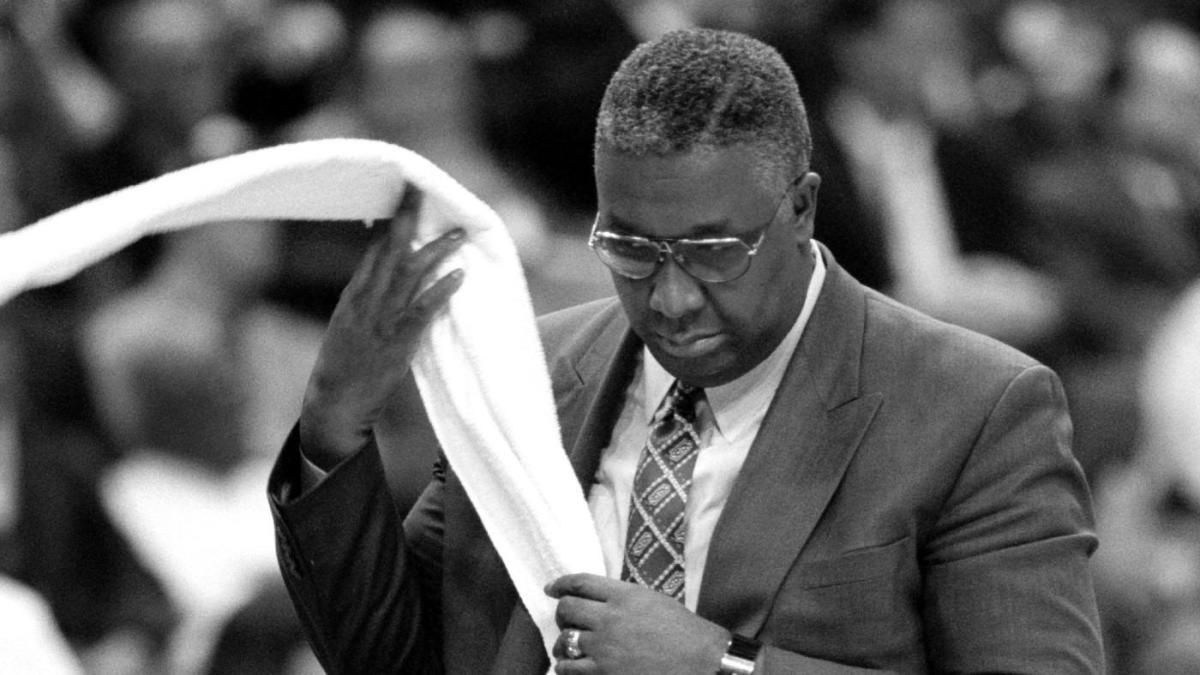

In case you missed it, today is National Coaches Day. In observance, I'm reposting an article I wrote several years ago on legendary coach John Thompson. Admittedly, those of us from a certain era will recognize more of the names, but the lesson and the story are both timeless. He was quite a guy. To paraphase James Earl Jones, I miss him and those like him....Damn few left . Lessons from a Legend Being a teenager and growing up in the 1980's, John Thompson's Georgetown teams were quite literally larger than life. Growing up on the outskirts of Philadelphia and being a college basketball fan, to me there was nothing better than watching those Big East battles in the early to mid 80's. Patrick Ewing, Ed Pinckney, Sleepy Floyd, Pearl Washington, Charles Smith, Reggie Williams, Chris Mullin, and on and on... And at the glorious center of it all was John Thompson. Invariably either yelling, scowling, laughing, teaching, coaching, or complaining (often in the same sequence), he stalked the sidelines with his gigantic white towel - and usually the win, slung over his shoulder. Despite his intimidating presence however, you didn't have to look too closely to find the appeal of John Thompson. Regardless of what happened on the hardwood, there was always a genuine post game embrace, a nod, and a warm smile for his adversaries lingering on the other side of the court - Especially Lou Carnesecca or Rollie Massimino. I loved seeing that - It endeared him to me, and I'm sure many others. Indeed, although there are many things worth remembering from those years - The introduction of the shirts under the jerseys courtesy of Patrick Ewing, Michael Graham's one and done year of defensive domination, and the discovery that a Hoya is not actually a bulldog - there is one that stands out. The 1982 NCAA Championship game. Thompson's upstart Hoya team was playing Dean Smith's heavily favored North Carolina Tar Heels. With just 17 seconds left, down by one with a chance to win, Georgetown's Freddie Brown picked up his dribble near the top of the key and turned to throw a pass to who he thought was Eric "Sleepy" Floyd, who only a moment earlier had been positioned just to his right. But Floyd wasn't there. In reaction to Brown's fake, he had proceeded down the right side, just outside the lane. Brown's pass drifted fatefully into the arms of a shocked James Worthy, who turned and dribbled out the remaining seconds, sealing not only the championship, but a few legacies as well. What has always stayed with me is not the game winning shot by a very young Michael Jordan just seconds earlier, the lapse of judgement and execution by rock solid team leader Brown, the championship loss, or Georgetown’s 1984 title over Houston's Phi Slamma Jamma team that served as retribution of sorts. What I remember most is Thompson, after the buzzer sounded and ignoring everything around him amidst the on court chaos, walking quietly and quickly to embrace and console his devastated player, who stood head in hands not knowing what to do or how to react to what had just happened. It was in that moment, with his arms tightly wrapped around one of the great unsung heroes of Georgetown basketball lore, that John Thompson showed his true self. In that moment, he showed us all that it really is about more than ourselves and our own achievements - About even more than team or personal goals. It's about each other and about our relationships to one another. A lesson we should all take to heart, especially now.

Why an SBA Express Line of Credit Might Be Your Best Move Need faster access to funds without sacrificing flexibility? The SBA Express Line of Credit combines the low-cost, reliable backing of the SBA with the agility small businesses crave. Here’s what sets it apart: 1. Super-Fast Response Times Unlike traditional loans, the SBA Express generally offers a 72-hour SBA decision on whether to guarantee your line of credit—so you can get going almost immediately. 2. Flexible, Revolving Access It's not a one-and-done loan. You draw only what you need, repay, then borrow again—like a credit card but with lower rates and smarter terms. 3. Competitive SBA Backing SBA guarantees up to 50% of the line, lowering risk for lenders and improving your chances. You benefit without sacrificing speed. 4. Use It for Whatever Keeps You Rolling Need to manage cash flow, cover payroll, buy inventory, or respond to emergencies? It’s your cushion. Just don’t use it for ineligible costs like real estate or debt refinancing. 5. Pay Interest Only on What You Use Unused portion? No interest. You only pay when you draw. 6. Potential Fee Advantage Some lenders waive fees on the Express Line—making it even more cost-effective compared to term loans. What to Watch For Maximum Line Size : Typically up to $350,000—enough for many small business needs, but not every big project. Interest Matters : Rates vary; always compare. Use Restrictions : Strictly business—no personal spending, real estate or investment purchases. Lender Discretion : The SBA sets the rules, but each bank interprets them. Ask specifically about their SLA (Service Level Agreement) and timeline. Renewal Terms : Some lenders may require annual renewal or fee. Why You Should Care If cash flow moves fast in your business, waiting weeks for a term loan can cost you. The SBA Express Line gives you business-grade funding on your terms—quickly, flexibly, and affordably.

Running a hair, nail, or lash salon isn’t just about delivering great service. It’s also about managing the constant challenges that come with owning a small business. From seasonal slowdowns to rising costs, many salon owners face cash flow gaps that can put their business at risk. That’s where working capital from an SBA 7(a) loan can make a difference. Common Problems Salons Face 1. Seasonal Fluctuations Many salons see a spike in revenue during holidays and wedding season, but slower months can strain cash flow. 2. Rising Supply Costs Hair color, nail polish, lash extensions — the cost of professional products keeps climbing, eating into margins. 3. Equipment Upgrades Chairs, dryers, manicure tables, and lash beds eventually need replacing. Without cash on hand, upgrades get delayed. 4. Staffing Challenges Keeping top stylists, nail techs, and lash artists often means offering competitive pay and benefits, which can be tough during slower periods. 5. Marketing & Client Retention Attracting new clients and keeping loyal ones takes consistent marketing — something many salons put off when funds are tight. How SBA 7(a) Working Capital Can Help The SBA 7(a) loan program offers salon owners affordable financing with flexible repayment terms. Working capital from an SBA loan can be used to: Cover payroll during slow months Buy supplies in bulk to save money Upgrade or replace equipment without draining savings Invest in advertising to bring in more clients Fund staff training to improve services and retention Because SBA loans offer longer repayment terms and lower rates than most alternatives, salon owners can manage cash flow without the pressure of short-term, high-interest debt. Bottom line: Whether you run a hair salon, nail spa, or lash lounge, having working capital ready can mean the difference between struggling through slow months or growing year-round. 📞 Contact ComCap today to see how an SBA 7(a) loan can help your salon thrive.

Share On: